知识问答

| 多伦多哪些区抢价格最厉害?哪些区竞价最弱? 哪些区争抢房屋激烈,哪些比较弱. 出租市场不太正常。 | |

|---|---|

|

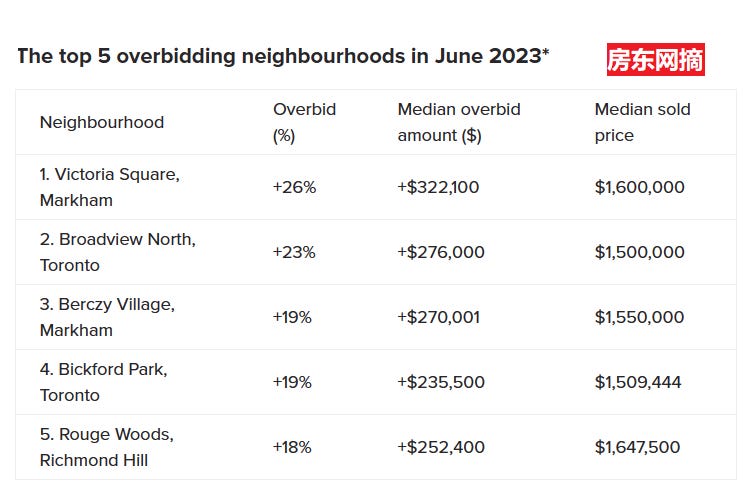

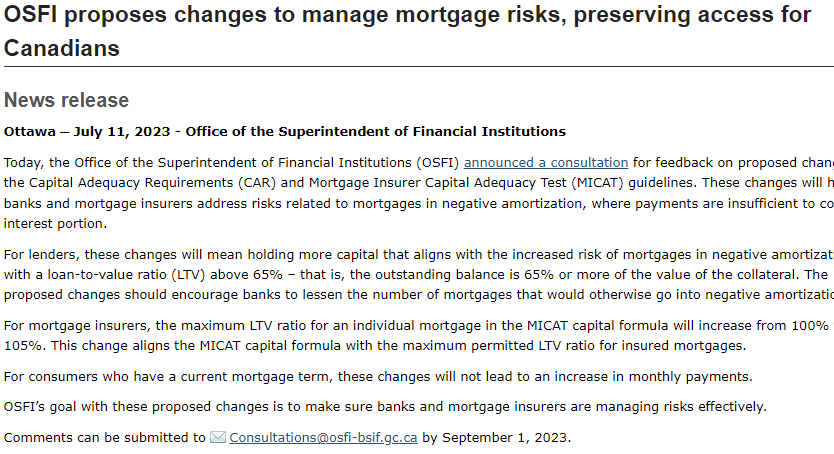

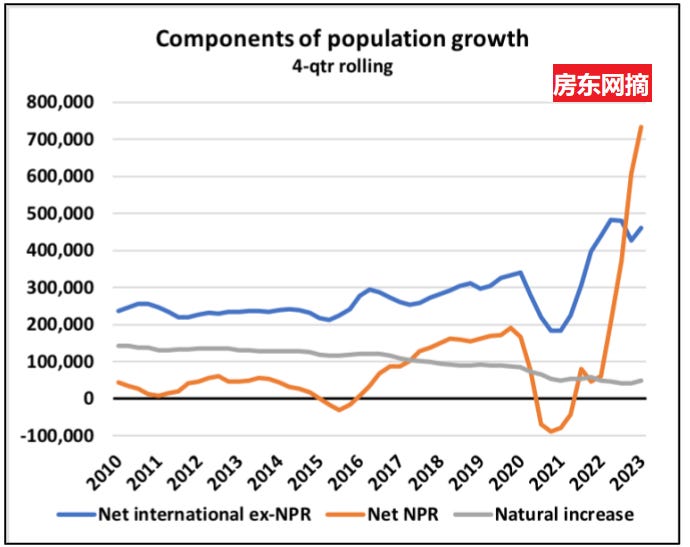

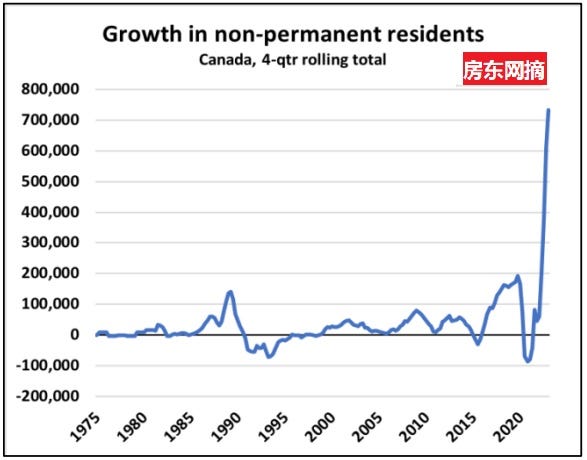

今天给房东网的村友带来的信息服务有三个话题:1)多伦多哪些区抢价格最激烈?哪些区竞价最弱?2)金融监管机构OSFI最新提议,建议贷款机构加强对贷款负摊还类型的风险管理;3)非居民人口增长带来非正常的租务市场 【1】多伦多哪些区抢价格最激烈? 由于六月加息, 大多伦多地区(GTA)的住房市场热度下降,春季市场的火热程度减弱。根据REM ( Real Estate Magazine) 的最新统计,在6月份,GTA地区326个社区中有203个社区出现了超出报价的情况,占比例62%, 相比5月有222个社区超出报价,占68%,6月有所减少。这是自今年1月以来首次出现的月度下降,见下图 下面是竞价幅度最高的Top 5的社区排行: 下面是Underbiding 也就是售价低于挂牌要价的Top 5社区排行: 上面图表中有您所在的区域吗? 【2】加拿大金融机构监管局(OSFI)宣布对资本充足性要求(CAR)和抵押贷款保险机构资本充足性测试(MICAT)指南提出修改建议,并征求意见,见官方网站: OSFl proposes changes to manage mortgage risks, preserving

access for Canadians News release Ottawa - July 11, 2023 - Office of the Superintendent of

Financial Institutions today, the 0ffice of the Superintendent of Financial

Institutions (OSFI) announced a consultation for feedback on proposed charter

Capital Adequacy Requirements (CAR) and Mortgage Insurer Capital Adequacy Test

(MICAT) guidelines. These changes will banks and mortgage insurers address

risks related to mortgages in negative amortization, where payments are insufficient

to interest portion For lenders, these changes wil mean holding more capital

that aliens with the increased risk of mortgages in negative amortize with a loan-to-value

ratio (lTv) above 65% - that is, the outstanding balance is 65% or more of the

va use of the collateral. The proposed changes should encourage banks to lessen

the number of mortgages that would otherwise go into negative amortization For mortgage insurers, the maximum LTV ratio for an

individual mortgage in the MICAT capital formula will increase from 100%105%,

This change aligns the MICAT capital formula with the maximum permitted LTV

ratio for insured mortgages. For consumers who have a current mortgage term, these

changes will not lead to an increase in monthly payments0SFI's goal with these

proposed changes is to make sure banks and mortgage insurers are managing risks

effectively.

Comments can be submitted to √ Consultations@osfi-bsif.gc.ca by

September 1, 2023. 对于咱们房屋贷款人来讲, 最重要的是这个提议

对于贷款机构来说,这些变更意味着需要持有更多与具有负摊还抵押贷款的风险相符的资本,也就是贷款价值比例(LTV)超过65% - 即未偿还余额占抵押品价值的65%或更多的这些贷款有着较高的风险, 银行贷款机构需要应对措施。这些政策变更的提议,应该会要求银行减少原本可能会进入负摊还状态的抵押贷款数量。 【3】学生租房市场争抢白热化 下图是过去4个季度加拿大人口增长情况示意图, 可以看到在过去12个月内将73万非永久居民(NPR Non Permanent Resident)引进加拿大,可以说这几乎全部为租房者。 这对租房市场产生了可预见的副作用。 这些新增人口让出租市场变得异常火热,尤其是学生出租市场。下面是一些房东们招租宣传共用的床位这里不是卧室……只是床位! 希望咱们华人的房东,不要这样过分出租,还是按照安省租务法的条例来做。 |